The price of Bitcoin has been moving at around $40,000 (USD) at present, making it one of the most expensive cryptocurrencies to purchase and invest in. However, Bitcoin has been fluctuating at an average rate of 4.5% for the past five years since 2017; the demand for Bitcoin is still massive, subsequently pushing its price further.

A historical review of the crypto market, particularly Bitcoin, shows that despite a history of scams and severe drops in the Bitcoin price, it has maintained high demand in the cryptocurrency market.

Given the rise of blockchain technology, relatively greater adoption of cryptocurrency, and how these are being viewed as potential gateways to the metaverse, understanding some of the foundational pioneers in these technologies is quintessential to comprehending what might come in the future.

The article covers all the fundamentals you need to know about Bitcoin, how it brought blockchain technology and the concept of cryptocurrency to the forefront, what determines its value, and other exciting Bitcoin facts. Read till the end to learn more!

What Is Bitcoin?

Bitcoin was the first cryptocurrency to be launched as a medium of exchange, built on blockchain technology. It follows a P2P or peer-to-peer network protocol wherein the need for a third-party intermediary is eliminated.

Holders of bitcoin crypto can send and receive value anytime from anywhere worldwide. Bitcoin is both a store of value and a means to transfer value because it’s a digital currency and a network of blockchain technology that further makes the movement of funds easy.

Contrary to the fiat currency, Bitcoin is created, distributed, stored, and traded with the help of a decentralized and distributive ledger system and peer-to-peer technology.

As the earliest decentralized digital currency, Bitcoin met extensive popularity and success, stirring the creation of a host of other cryptocurrencies in its wake.

What Is The History Of Bitcoin?

The originality of online currencies has been relatively old. For example, before the launch of Bitcoin, from 1998 to 2009, in the pre-Bitcoin years, technologists and computer scientists made attempts to create encrypted online currencies with ledgers.

B-Money and Bit Gold are two examples of online currencies formulated before Bitcoin; however, they were not developed completely.

In 2008, a mysterious individual or group named Satoshi Nakamoto published a white paper titled “Bitcoin: A Peer-to-Peer Electronic Cash System” that entailed everything about how Bitcoin operates today.

The Bitcoin software was made available to the public for the first time in 2009, enabling the Bitcoin mining process to begin. Before the software launch, the first Bitcoin block — Block 0, also known as the “genesis block,” was mined and entailed the following text, “The Times 03/Jan/2009 Chancellor on the brink of second bailout for banks.”

In 2010, Bitcoin was valued for the first time when someone decided to exchange 10,000 bitcoins for two pizzas. Since their inception, they had only been mined but never traded, making it impossible to assign value to them.

Alternative cryptocurrencies to Bitcoin, known as Altcoins, began to develop around 2011. Their purpose was to enhance and build on the original Bitcoin technology by offering greater momentum, anonymity, or other advantageous features. Namecoin and Litecoin were the first altcoins among more than a 1000 cryptocurrencies available today.

From 2013 till today, the price of Bitcoin has had a bumpy ride with months of stagnation, fluctuations to reaching an all-time high and settling at an average value again. The history of Bitcoin is undoubtedly enthralling.

How Does Bitcoin Work?

Without plunging into the technicalities of the technology behind making bitcoin work, let us understand how the Bitcoin system works in the simplest way possible.

- Firstly, Bitcoins are created by a process called crypto mining, also known as bitcoin mining, which requires ‘mining rigs.’ These are specialized computers used to perform complex equations to verify and record new transactions.

- Next, the collective computing power of miners worldwide is used to ensure the accuracy of the verified transactions that are then added to the ever-growing Bitcoin blockchain. Each new bitcoin is attached to its preceding transaction.

- Mining is an essential and constant process to keep the Bitcoin blockchain running. For that reason, the Bitcoin network organizes lotteries wherein mining rigs around the world compete to solve a math problem. The first to solve the problem updates the Bitcoin ledger and receives Bitcoins as rewards.

- Bitcoin miners involved in the process receive a public and a private key. These keys are stored in the virtual digital wallet that a person owns and are collectively known as a ‘key pair.’ The public key is used to receive funds, and a private key is used to sign transactions to spend the funds.

How To Get Bitcoins?

There are three ways to get bitcoins. One can either participate in the bitcoin mining process, purchase them from a crypto exchange platform, or accept them in exchange for goods and services.

Crypto exchange places like Coinbase, Gemini, and Kraken are some of the platforms that enable people to trade cryptocurrencies in exchange for fiat money or other digital currencies. In addition, payment services like PayPal, CashApp, and Venom have also introduced new features to their online portals, allowing users to trade and hold cryptocurrencies.

What Is Bitcoin Mining?

Similar to the crypto mining process, bitcoin mining is also how new bitcoins are generated. A miner has to solve a complex computational puzzle to mine a bitcoin. The process is necessary to maintain the ledger of transactions upon which the crypto is based.

Over the years, the bitcoin mining process has become very sophisticated. As a result, companies have incorporated complex machinery to speed up the mining process, thus maximizing and utilizing its potential as a business opportunity.

Contrary to the optimism regarding revenue opportunities offered by the crypto mining industry, bitcoin mining has been subjected to controversy for not being considered environmentally friendly.

Bitcoin mining incorporates large systems that are as massive as data centers. Bitcoin’s algorithm generates mathematical puzzles that these systems solve to produce new bitcoins. In addition, this process helps verify its transactional information, thus making the Bitcoin network trustworthy.

The math puzzle that is required to be solved to generate new bitcoins is called proof-of-work or PoW. The mining difficulty of the puzzles changes every two weeks, and its level depends on the miners’ efficiency in the preceding bitcoin mining cycle.

Another possibility for the mining difficulty level depends on the number of bitcoin miners competing to solve the puzzle. For instance, a reduction in the computational power adjusts the difficulty to a notch down, making mining easier.

How Is The Bitcoin Price Determined?

The price of a Bitcoin is determined by certain economic factors, including supply and demand for the bitcoin, its cost of production that entails electricity and internet connection bills, the number of competitors, government intervention in terms of regulations on the use and trading of crypto, and attention from the media in the form of special coverage on bitcoins.

Initially, when bitcoin was launched, it technically was considered valueless and unproductive. However, by the end of 2019, bitcoin was trading at around $7,500. With the rise in bitcoins’ value, it has become more divisible, becoming an essential attribute of its popularity and accessibility.

In addition, Satoshi Nakamoto set a cap on the overall supply of bitcoins at 21 million, ensuring the scarcity of the crypto and its reasonably moderative prices. Currently, 3 million bitcoins are estimated to be available for mining, which will happen gradually. Theoretically, the last bitcoin blocks will be mined in 2140.

Apart from these facts, the ability of bitcoin to function as a store of value, allowing easy portability and divisibility, make it apt for all kinds of transactions, big or small.

In a nutshell, bitcoin is scarce, secure, portable, divisible, accessible, and usable; all these characteristics determine bitcoin’s price in the crypto market.

What Has Been The Price History of Bitcoin?

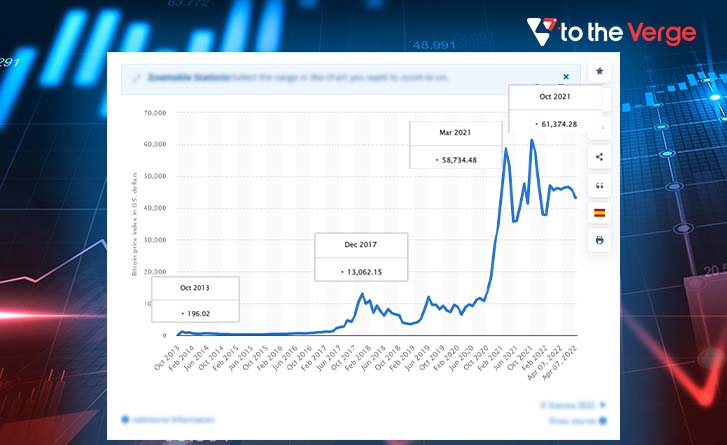

Bitcoin has had a turbulent and volatile price history since its inception. Over the past twelve years, bitcoin’s price has risen and fallen sharply.

Starting with a bitcoin price in USD of $196.02 in October 2013, it reached its first high valuation at $13,062.15 in December 2017. The second high valuation of bitcoin happened in March 2021 at $53784.48, ultimately reaching an all-time high of $61374.28 in October 2021. At present, the USD price of bitcoin is $38,928.50.

Should One Invest In Bitcoin?

There are certain risks and potential rewards like any investment, whether in bitcoin crypto or the traditional money market. Therefore, the investor needs to be neutral and reasonably observe the market trends.

However, relative to traditional ways and types of investments, investing in Bitcoin and other cryptos can be tricky and potentially risky. Moreover, given the price history of Bitcoin, it is evident that this cryptocurrency has been highly volatile. Therefore, before investing in bitcoin, one must have a general understanding of cryptocurrencies and a good knowledge of bitcoin.

FAQs

Q1. How Long Does It Take To Mine One Bitcoin?

Depending on the miner’s hardware, the time to mine a bitcoin may vary. For example, powerful machines and greater internet bandwidth could take 10 minutes to mine one bitcoin on average.

Q2. How To Become A Bitcoin Miner?

To become a bitcoin miner, you’ll require to set up a mining rig encompassing adequate hardware and software. A machine with greater computational power and lower energy consumption would be preferable to save costs. In addition, an internet connection with good bandwidth is also a must for the mining process.

Next, you’ll require a bitcoin wallet to receive and send the bitcoins mined. And finally, by joining a mining pool, you could begin with bitcoin mining.

Q3. Is Bitcoin Harmful For The Environment?

Bitcoin mining requires solving a mathematical puzzle known as Proof-of-Work or PoW. In addition, the process is pretty energy-intensive as it requires enormous amounts of electricity to power millions of servers. According to a study, Bitcoin mining takes 91 terawatt-hours of electricity annually, more than seven times what Google uses for its global operations. Henceforth, it is not entirely environment-friendly.

The Bottom Line

Bitcoins were the first official cryptocurrency to enter the market and pioneered the use of blockchain technology for finance. Moreover, it inspired the creation of other cryptocurrencies; remains one of the most popular and in-demand cryptos. Therefore, one can discover a lot about the crypto market by investing in bitcoin. Though it is volatile, bitcoin can be experimented with.

Nitisha Lal is a writer enthusiastic and curious to learn new things. Currently, she writes about the latest developments in technology, particularly around Web3 and the Metaverse. She enjoys nature walks, capturing the world around her on the phone, or reading books when away from work.

![How to Update and Reinstall Keyboard Drivers on Windows 10/11 [A Guide]](https://wpcontent.totheverge.com/totheverge/wp-content/uploads/2023/06/05062841/How-to-Update-and-Re-install-Keyyboard-Drivers-on-Windows-10.jpg)