Finance and technology are two domains that keep people engaged globally. The dynamic and uncertain character of these fields is thrilling and alluring at the same time. But, what happens when the two combine to create an all-unique asset – a digital currency, or shall we say cryptocurrency!?

For a few years, discussions on crypto have been on the rise; finance and technology news mention it quite frequently too! Consequently, one should know what the history and basics of cryptocurrency are? How does it work? What are the advantages and disadvantages of crypto? And other essential cryptocurrency terminology and technology. This article aims to explain crypto in the simplest way possible. Read till the end to know more!

What Is Cryptocurrency?

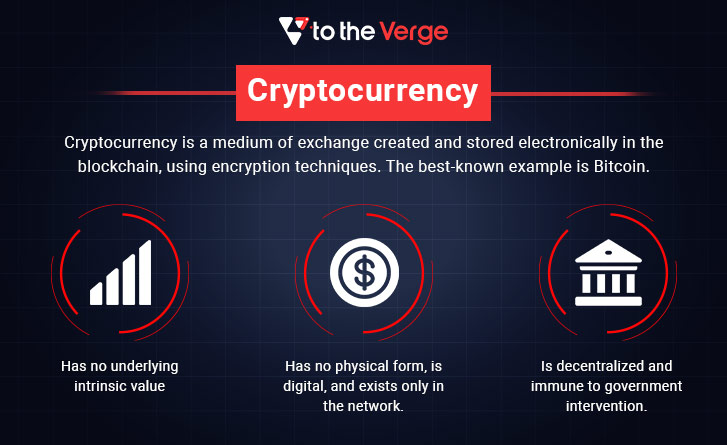

A cryptocurrency can be defined as a decentralized virtual digital currency designed to be used over the internet, which is generally not issued by any central authority.

This decentralized digital currency is based on blockchain technology, which records transactions related to cryptocurrency funds on a public ledger. Cryptocurrencies use advanced coding to store and transmit data between these ledgers and the digital wallets used to keep them. It is nearly impossible to counterfeit or double-spend crypto as it is secured by cryptography, a communication technique that allows only the sender and the receiver of a message to view the content.

Crypto coins are theoretically immune to government intervention and manipulation, given their decentralized and distributed nature. In addition, as a result of encryption, they enable secure online payments without the need for third-party intermediaries.

When Was Crypto Invented?

The history of cryptocurrency can be traced back to the 1980s when they were known as cyber currency. During that time, the Blinding Algorithm was invented that essentially aimed to enable secure and immutable transactions, which remains fundamental even to the modern-day digital currency.

However, the crypto-currency rose to popularity only in 2008 with the introduction of Bitcoin, which is the most well-known cryptocurrency created by an anonymous programmer or group of programmers under the pseudonym Satoshi Nakamoto. In 2009, Bitcoin was officially launched globally, but it was formally recognized as a means of payment among leading merchants in 2012, starting with WordPress.

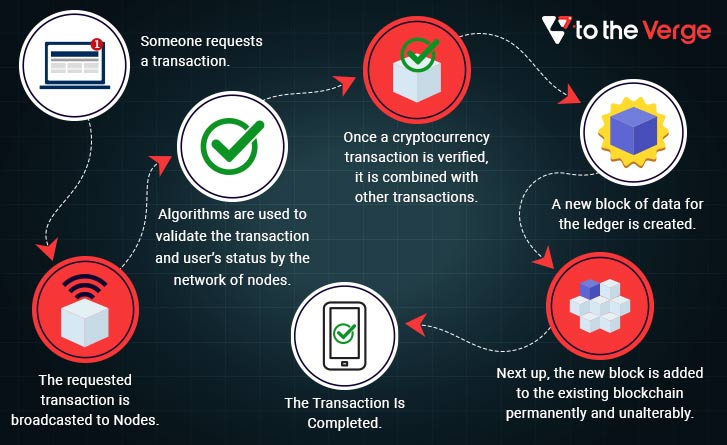

How Does Cryptocurrency Work?

Understanding how crypto or cryptocurrency works requires a basic comprehension of the following terms: blockchain and cryptography. Blockchain is the underlying technology that governs crypto-currency. It is a distributed public ledger that uses a system of recording information in blocks across a network of computers, making it difficult to modify or tamper with it. Furthermore, since access to the ledger is shared among authorized users, any information transmitted is immediate and transparent.

Crypto coins are secured from unauthorized access by specific encryption techniques known as cryptography, including elliptical curve cryptography, public-key cryptography, and hash functions. With the help of these techniques, cryptocurrencies transfer coin ownership on the blockchain.

Public-key cryptography generates a pair of public and private keys that helps in robust authentication. A private key is an ultra-secure password. It can send value on a network and need not be shared. On the other hand, a public key is used to receive value on a network. As a result, people can share an associated public key freely with others over the web. Together, they make the transfer process of crypto ownership secure, which is how cryptocurrency works.

What Is Crypto Mining?

Crypto Mining is one of the essential terms in crypto terminology. It is a process that uses computing power to solve complicated mathematical problems and generate crypto coins. Mining is a complex process, and it requires miners to solve mathematical puzzles over specially equipped computer systems in return for which they are rewarded with the coins. Besides generating crypto coins, mining is also used to revise and secure the network by continually verifying the public blockchain ledger and computing new transactions.

Anyone can become a crypto miner, provided with a computer and an internet connection. Moreover, one should note the cost of mining may be higher than its profitability, depending upon the crypto-currency being mined and the cost of electricity in one’s area. Since it can be a costly affair, most crypto mining these days is either done by a large group of individuals who bring together their computing power or by companies specializing in it.

Some of the top crypto mining companies are Bitfarms Ltd. (BITF), BIT Mining Ltd. (BTCM), Argo Blockchain PLC (ARBK), and there are many more.

Lotteries are held by the network where all the mining rigs across the world race to solve some maths problems first. In the case of Bitcoin, these include the hashing problem, the byzantine generals problem, and the double-spending problem. On winning, the miner is awarded a new coin, broadening its presence in the marketplace.

What Is Crypto Exchange?

A platform on which one can buy and sell cryptocurrency is effectively a crypto exchange. Such platforms enable the trade-off of one cryptocurrency for another or the purchase of crypto using regular currency. So essentially, a crypto exchange is a digital marketplace.

Once crypto-currency is purchased, it is stored in a crypto wallet. Cryptocurrencies are not tangible. Therefore, what a crypto owner essentially owns is a key that would enable them to move a record or transaction over the network without any third party. Crypto wallets that can either be a physical device or online software service are available to store the private keys to cryptocurrencies securely.

Some exchange platforms provide wallet services, making it easy for those dealing in crypto to store the currency directly through the platform. Besides accessibility, security, and liquidity, one can look for wallet features in a crypto exchange.

How is Crypto Price Determined?

The price of cryptocurrency is determined by the supply and demand for these, just like in the case of commodities and services. Supply refers to the availability of the coins, and demand relates to people’s willingness to buy the coins at different prices. A balance between these two elements will always determine the economic value or price of the cryptocurrency.

Besides the supply-demand economics, factors such as technology and use-cases, regulations, market response, and social-media frenzy, among others, influence the price of crypto in the market.

Is It Worth Investing In Crypto?

The advantages and disadvantages of cryptocurrency can be considered when investing in crypto. To begin with, the following are three positive advantage points of investing in crypto:

- A New Paradigm of Money. Cryptocurrency represents the future alternative to the traditional banking system. It offers seamless equality in the sense that any owner can buy crypto irrespective of where in the world they live. In addition, the feature of being decentralized and not border restricted enables the use of crypto to facilitate free trade.

- Direct and Fast Transferability. Cryptocurrency makes transactions with people seamless globally without depending on a third party. In addition, the average time to process fiat money is estimated at around one to two days; however, bitcoin only takes an hour to process. Therefore, sending cryptocurrency is faster and more cost-effective than international wire transfer.

- Secured By Cryptographic Encryption. Cryptocurrency is built and developed on blockchain technology; therefore, they are constantly checked and verified by a vast amount of computing power. Moreover, these are encrypted, ensuring user anonymity protecting personal financial information and identity.

In contrast to the advantages mentioned above, the following three cryptocurrency disadvantages exist:

- Prone To High Risks. The price volatility of cryptocurrencies adds to their speculative nature, making their value prone to a sharp downfall because there is no inherent value in a digital currency. As a result of the absence of an actual underlying value, some economists consider cryptocurrencies a speculative bubble.

- Money Laundering and Illicit Purchases. Cryptocurrency, as mentioned above, ensure anonymity due to encryption. However, this sometimes plays against the greater good as criminals use it for illicit activities and money laundering. In addition, they are also used by hackers for ransomware activities.

- Ownership and Scalability. Though the ownership of cryptocurrencies, in theory, was meant to be decentralized, implying their wealth was to be distributed across many parties on the blockchain, a study found it to be highly concentrated. For example, a research paper by the National Bureau of Economic Research on the blockchain technology and bitcoin market found that only 11,000 investors held 45% of Bitcoin’s surging value. One might assume that the technical scalability issue of blockchain technology is responsible for this disproportion.

Given cryptocurrency’s advantages and disadvantages, if one has a good risk appetite and wants to benefit from digital currency directly can invest in cryptocurrency. Alternatively, a safer but potentially less lucrative option could be buying the stocks of companies dealing in cryptocurrency.

What Are The Use-Cases of Cryptocurrency?

After understanding the basics and terminology of crypto, one might wonder what can be done with crypto-currency? Crypto coins can be used in many places, just like money. Bitcoin was first launched to be a medium of exchange for daily transitions; while this hasn’t been marginalized entirely, institutions are gradually accepting it. Some technology and e-commerce websites, luxury retailers, car dealers, and even insurance companies have begun to explore the crypto horizon. For instance, the Swiss insurer AXA announced in April 2021 that it would accept Bitcoin from its Swiss Clients as a mode of payment for all non-life insurances.

Other Frequently Asked Questions

1. Why do we need crypto?

Crypto-currency is needed to fix the limitations of traditional currencies potentially. Furthermore, the holder of cryptocurrency is entitled to its ownership completely. No third-party or government intervention exists; as a result, there is no limit on transactions, the threat of identity theft, or denial of service.

2. How does cryptocurrency work for dummies?

Cryptocurrency can be explained simply as a type of currency that exists virtually and digitally. It uses cryptography to secure transactions.

Summary

The future of cryptocurrency as new money may or may not be accurate; however, since it is actively increasing and developing, besides the traditional global economy, one should know the crypto ecosystem. Therefore, understanding the basic crypto definition, what it is, and how it functions will go a long way in better comprehending current financial and technological developments.

Nitisha Lal is a writer enthusiastic and curious to learn new things. Currently, she writes about the latest developments in technology, particularly around Web3 and the Metaverse. She enjoys nature walks, capturing the world around her on the phone, or reading books when away from work.

![How to Update and Reinstall Keyboard Drivers on Windows 10/11 [A Guide]](https://wpcontent.totheverge.com/totheverge/wp-content/uploads/2023/06/05062841/How-to-Update-and-Re-install-Keyyboard-Drivers-on-Windows-10.jpg)